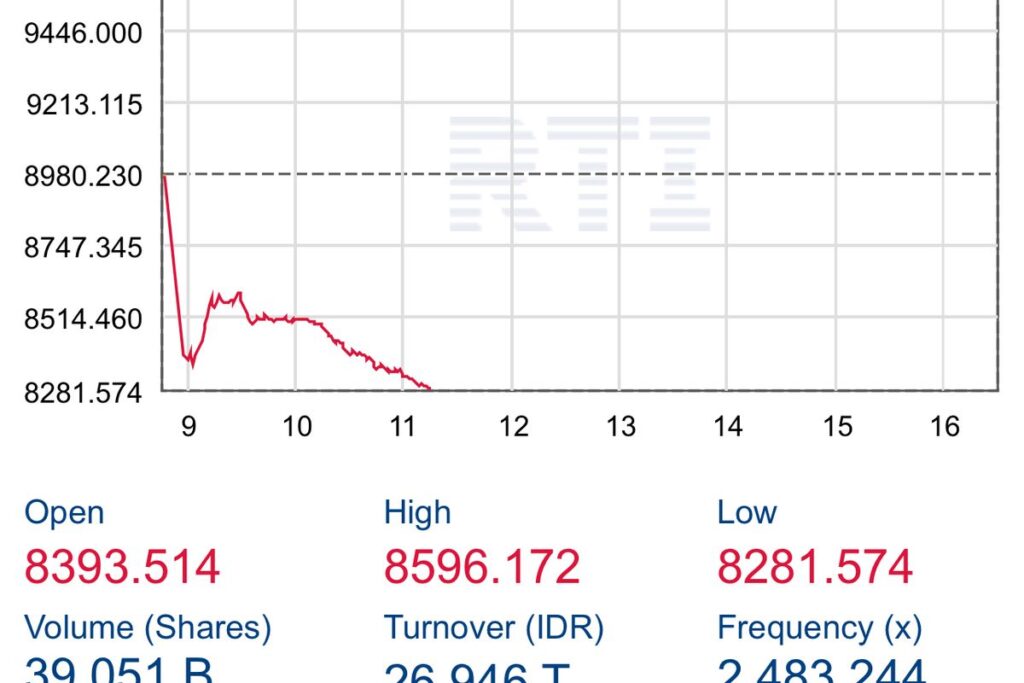

Jakarta – Indonesia’s benchmark stock index, the Jakarta Composite Index (JCI/IHSG), came under severe pressure ahead of the close of the first trading session on Wednesday (January 28, 2026), tumbling 7.71 percent or 692.47 points to 8,287.76 as of 11:15 a.m. local time.

The index opened weaker at 8,393.51, briefly attempted a rebound, and touched an intraday high of 8,596.17. However, the recovery proved short-lived as selling pressure quickly returned, pushing the index down to a session low of 8,281.57.

Responding to the sharp decline, the Indonesia Stock Exchange (IDX/BEI) stated it would intensify coordination with all relevant stakeholders to address the heightened market volatility.

IDX Director of Corporate Valuation I Gede Nyoman Yetna said the exchange is prepared to take necessary measures in collaboration with capital market participants.

“Essentially, today we will make every effort to work closely with all of our stakeholders to follow up on matters that are deemed necessary,” Nyoman told reporters.

Regarding the outlook for the next trading session, Nyoman emphasized that the exchange would continue to closely monitor market dynamics.

“We will observe the conditions,” he said.

MSCI Decision Triggers Market Sell-Off

The sharp sell-off followed a decision by MSCI to temporarily suspend several index changes involving Indonesian-listed companies. The move was driven by concerns over high ownership concentration in a number of Indonesian stocks.

According to Bloomberg, the suspension will remain in effect until market authorities, including the IDX, are deemed capable of adequately addressing concerns related to ownership structure and market transparency.

In its statement, MSCI announced that it would halt the addition of Indonesian stocks to its indices and freeze increases in investable share factors. The decision was based on persistent concerns over investment eligibility, including the potential for coordinated trading practices that could distort price formation.

MSCI further warned that if sufficient progress is not achieved by May 2026, it may reassess Indonesia’s market accessibility status. Such a review could result in a reduction of Indonesia’s weighting in the MSCI Emerging Markets Index, or even a downgrade from emerging market status to frontier market.

The announcement was officially released on Tuesday (January 27, 2026), following the completion of MSCI’s market consultation process on Indonesia’s free float assessment. While some global investors supported the use of the Monthly Holding Composition Report issued by Indonesia’s Central Securities Depository (KSEI) as a supplementary reference, the majority expressed serious concerns—particularly regarding the classification of shareholders in KSEI data.

MSCI noted that despite minor improvements in free float data provided by the IDX, investors remain unconvinced that core issues surrounding transparency and ownership concentration in Indonesia’s equity market have been fully resolved.

As Southeast Asia’s largest capital market, Indonesia now faces mounting pressure to accelerate reforms aimed at restoring investor confidence amid increasingly fragile global market conditions.

Author: Faisal / FKY

Sumber: money.kompas.com/

#KiniMediaJakarta #KiniMedia #KiniMusik

#IHSG #IndonesiaStocks #MSCI #EmergingMarkets #GlobalMarkets #CapitalMarkets #MarketVolatility #IDX #IndonesiaEconomy